How Much Is the Insurance for a Sports Car?

Contents

If you’re thinking about buying a sports car, you’re probably wondering how much the insurance will cost. Here’s a look at what you can expect to pay for insurance on a sports car.

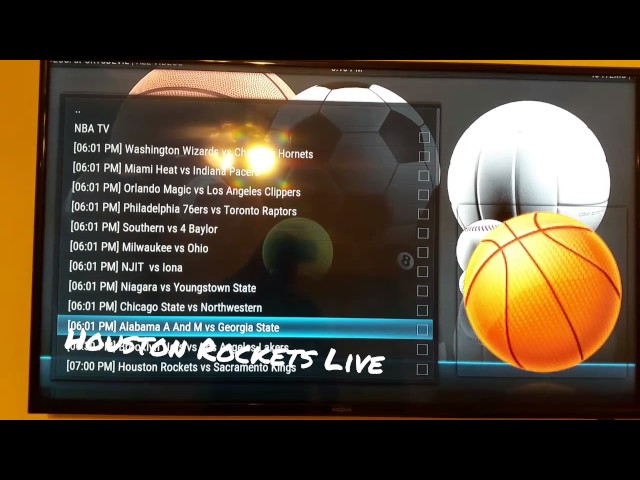

Checkout this video:

Introduction

There is no simple answer to the question, “How much is the insurance for a sports car?” In order to get an accurate estimate, you will need to factor in a number of variables, including the make and model of the car, your driving record, the purpose for which you will be using the car, and the amount of coverage you require. That said, here are some general guidelines that can help you get an idea of how much it might cost to insure a sports car.

What is a sports car?

A sports car is a vehicle designed for speed and agility, typically with two seats and a low center of gravity. Sports cars may be built for the road or track, with a variety of powertrains and other performance-enhancing features. While they can be fun and exciting to drive, sports cars also tend to be more expensive to insure than other types of vehicles.

How much is the insurance for a sports car?

There are a few factors that come into play when insurance companies are determining your rates for sports car insurance. The make and model of the car, your driving history, where you live, and your credit score are all things that will affect how much you pay for insurance.

The make and model of the car is one of the biggest factors in how much your insurance will cost. A newer, more expensive car will almost always cost more to insure than an older, cheaper one. This is because newer cars are worth more money, so there is more at stake if they are totaled in an accident. In addition, newer cars often have features that make them more likely to be stolen, such as GPS systems and remote start. This also increases their insurance rates.

Your driving history is another factor that will affect how much you pay for sports car insurance. If you have a clean driving record with no accidents or speeding tickets, you will most likely pay less than someone who has had accidents or tickets. Insurance companies view people with clean driving records as less of a risk, so they charge them lower rates.

Where you live also plays a role in how much you pay for sports car insurance. People who live in urban areas typically pay more for their insurance than people who live in rural areas. This is because there is more traffic and congestion in urban areas, which means there is a greater chance of being involved in an accident. In addition, crime rates are usually higher in urban areas, which means there is a greater chance of your car being stolen or vandalized.

Your credit score is another factor that insurance companies take into consideration when determining your rates. People with higher credit scores are seen as being more responsible and less likely to file claims. As a result, they often pay less for their insurance than people with lower credit scores.

What are the factors that affect the insurance for a sports car?

There are many factors that affect the insurance for a sports car. The type of car you drive, your driving record, the amount of coverage you need, and the state you live in all play a role in determining your insurance rates.

Sports cars are generally more expensive to insure than other types of vehicles because they are more likely to be involved in accidents. Insurance companies also consider sports cars to be a higher risk because they are often driven at high speeds and may be used in racing events. If you are considering purchasing a sports car, be sure to check with your insurance company to get an estimate of how much it will cost to insure before making your purchase.

Conclusion

Based on the information gathered in this research, it appears that insurance for a sports car will be significantly more expensive than insurance for a sedan or SUV. The main factors affecting the price of insurance are the make and model of the car, as well as the driver’s personal circumstances. Drivers with a clean driving record and no accidents will usually pay less for their insurance than those with a less-than-perfect history.